NIGERIA – Leading wheat-based products manufacturer in Nigeria, Honeywell Flour Mills Plc, has reported a 23% rise in revenue to N40.6 billion (US$96.9m) in the first quarter ended June 30, 2022 compared to N33 billion (US$78.7m) recorded in the corresponding period in 2021.

Despite the growth in revenue, the company reported a N2.4 billion (US$5.7m) loss for the period compared to a profit of N150 million (US$360,000) in the previous period.

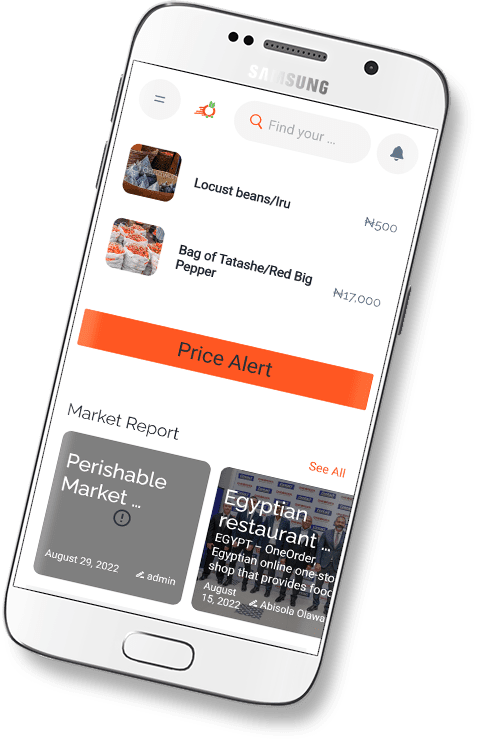

ADVERT

According to the company, this is due to the impact of the unprecedented socio-economic environment and global inflationary strains.

In a disclosure signed by Osomomen Olukoya, the company secretary, it stated, “The quarter reflects the impact of the unprecedented socio-economic environment and global inflationary strains.

“These market disruptions led to incessant increases in input costs, particularly of wheat and diesel which pushed up prices of the company’s products relative to locally produced substitutes.”

The company which became a member of Flour Mills of Nigeria Group on the 12th of May 2022 after the successful completion of the acquisition transaction says it continues to take pragmatic steps towards building a more sustainable brand.

ADVERT

Nassib Raffoul, the Managing Director of the company said, “We are confident that our performance in the second quarter of the year will record significant improvement. We are deploying measures to cushion the effect of the exacerbating input prices while also strengthening and expanding our business portfolio by accessing new markets and driving margin improvement through operational efficiency.

“We will continue to execute our five core strategic pillars through three drivers of growth, efficiency and capability. And with consumers’ behavior evolving faster than ever, we are adapting to this new reality by executing with speed to meet the need of our multiple stakeholders. We are committed to investing in our capabilities, know-how, and talents to continue to create value.”

Honeywell’s new parent company, Flour Mills of Nigeria has also reported on its first quarter performance, recording 45.3% rise in first quarter revenue to N339.6 billion (US$810m) from N233.7billion (US$557.9m).

The bullish top-line performance was supported by solid growth across all the company’s segments i.e., Food, Agro-Allied Sugar, and Supportive operations.

The Food segment attained 45% rise in revenue to N213.166 billion (US$508.9m) from N146.925 billion (US$350.7m) in 2021 while Agro-Allied segment registered a 37% growth to N65.652 billion (US$156m) from N47.688 billion (US$113m).

ADVERT

Its sugar portfolio saw a 64% revenue with stabilized trading environments and strong demand for brown sugar which is locally produced at its farm in Sunti.

Meanwhile the animal feeds business attained 21% revenue growth, driven by investments in logistics infrastructure and farmer training extension services across the country.

The interim results which were released to the Nigerian Exchange Group (NGX) indicated that operating expenses increased by 52% to N14.7 billion (US$35m), versus the prior period of 2021 which stood at N9.7billion.

In the period under review, Flour Mills of Nigeria reported a nearly one per cent increase in profit before tax to N7.33billion (US$17.5m) in Q1 2022 from N7.26billion (US$17.3m) in Q1 2021, while profit after tax closed Q1 2022 at N5.49billion (US$13.1m), representing an increase of one per cent from N5.45billion (US$13.01m) in Q1 2021.